Tata AIA Daily life shall have the right to assert, deduct, regulate, Get well the amount of any relevant tax or imposition, levied by any statutory or administrative overall body, from the benefits payable underneath the Coverage. Kindly refer the sales illustration for the precise premium.

$$Tata AIA Vitality - A Wellness Application that gives you an upfront lower price at plan inception. You may as well earn premium low cost / go over booster (as applicable) for subsequent many years on policy anniversary foundation your Vitality Standing (tracked on Vitality app) (two) Be sure to refer rider brochures For extra specifics on overall health and wellness Positive aspects.

The fund maintains flexibility to speculate in meticulously selected companies which provide prospects across significant, mid or small capitalization House

Tata AIA Param Raksha Lifetime Pro + is an extensive lifestyle insurance Option providing in depth protection as well as wealth generation Rewards. It offers adaptable options for securing Your loved ones’s upcoming although maximizing money growth by way of market linked returns$.

The different funds supplied below this contract would be the names from the resources and don't in any way show the standard of these designs, their long run prospects and returns. On survival to the top in the policy time period, the whole Fund Value together with Top rated-Up Top quality Fund Benefit valued at relevant NAV about the day of Maturity will probably be paid out.

The Wellness$$ Program is based on factors you can earn by completing on the web health and fitness assessments and by meeting every day and weekly physical activity ambitions.

The customer is advised to refer the in-depth sales brochure of respective individual products mentioned herein prior to concluding sale.

Relevant for department walk in. Closing date to submit declare to Tata AIA by 2 pm (Doing work days). Topic to submission of total files. Not relevant to ULIP procedures and open title promises.

Tata AIA Life Insurance provider Ltd. isn't going to suppose duty on tax implications mentioned anywhere on This great site. You should talk to your personal tax consultant to grasp the tax Added benefits available to you.

The target of the Fund is usually to crank out funds appreciation in the long run by purchasing a diversified portfolio of companies which official statement would gain from India’s Domestic Intake expansion story.

These merchandise may also be available for sale independently without having The mix presented/ advised. This profit illustration could be the arithmetic combination and chronological listing of merged benefits of unique items.

For aspects on goods, linked hazard factors, terms and conditions remember to examine Sales Brochure cautiously ahead of concluding a sale. The exact phrases and affliction of the system are laid out in the Coverage Agreement.

4All Premiums inside the coverage are exceptional of applicable taxes, obligations, surcharge, cesses or levies that can be completely borne/ compensated through the Policyholder, browse this site in addition to the payment of these Quality.

It's not an investment information, be sure to make your own private unbiased conclusion immediately after consulting your economic or other Qualified advisor.

ULIPs supply the flexibleness of selecting between distinct cash according to the policyholder's danger appetite and share market investment plans. The policyholder can switch involving various cash According to their economic plans and industry disorders.

$The address high quality paid in Device Connected Existence Insurance policy policies are issue to investment challenges linked to capital marketplaces and also the NAVs on the units may possibly go up or down determined by the efficiency of fund and factors influencing the funds industry plus the insured is responsible for his/her selections.

ULIP means Device Joined Insurance policies Plan, that's a variety of insurance coverage products that combines the key benefits of lifetime insurance policy and investment in an individual prepare.

The maturity gain provided underneath this plan is the total fund worth of your investment at 4% or eight%, as maturity7 quantity including loyalty additions together with other refundable charges, along with the return of each of the rates paid toward the Tata AIA Vitality Guard Advance everyday living insurance coverage policy.

Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Andrea Barber Then & Now!

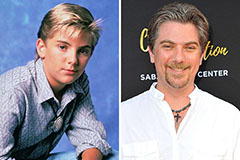

Andrea Barber Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!